I hope you are well, and enjoying all the crazy volatility we've been seeing lately in the markets. Like this past Friday with Crude selling down to $58 barrel and DOW dropping 315 points for the Day.

Lets dive into the Charts and see what's going on: Russell 2000 leading the way drops 14.5 points, with the Nasdaq, and S & P 500 following behind.

Allot of this sell off we've been witnessing this week is a direct result of what's happening with Crude selling off. Even the TF Russell has early in the morning would push higher this disbelief with crude going lower is really pulling the Financials down and waning heavily.

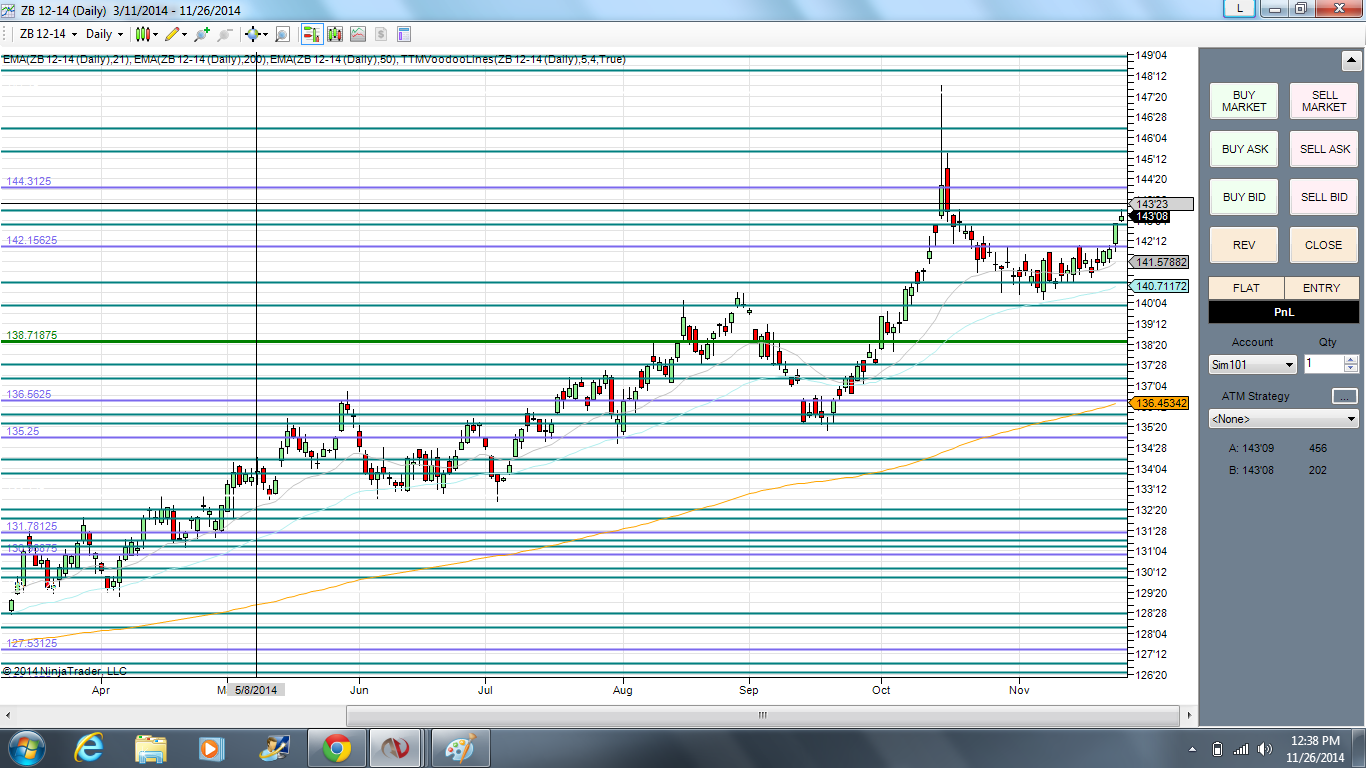

If you've been steady reader you know how I've been very bullish on the 30 yr Bond, We are now approaching the highes of 148 and at 146' 20/32 we look to test the highes at least and possible push through.

Its been interesting watching GC our Gold Futures Contract selloff but then have a pretty good retracement bounce back up to the Green Tree Line @ $1223 level. I don't expect it stay in a upward move very long, price should get rejected from this Tree Line and continue its coarse much, much lower like I've already said before. Watch out for allot of manipulation and volatility in Gold though by the market makers,and HFT to try and push the short sellers out, hit their stops, grab that liquidity in the market and then drop the market much lower...

Look for the Dollar to continue from this level much higher, as you can see on this chart I'm taking some profits off the table at this next Fire Line @$89.650. This is great intial target to take some profits off and let this baby roll on...

As far as the indices are concerned and if your wondering are we going higher from here? I would say it looks very good, we do have a big Fed meeting this Wed, 17th as the official FOMC statement will be coming out and will see a wild ride but if you look at this chart below we are not even at a 50% retracement level yet. So if there is some more downside below this 38.2 level into the 50% LEVEL, I would expect some very aggressive buying and honestly I look to see the markets rebound pretty good this week all the way into Christmas and into the New Year. Look for continued gas prices to Fall, I fully expect we see $2/gallon here in January.

Stay safe out there shopping, Christmas is right around the corner now :)

Happy Trading,

-david